There’s a lot of noise out there at the moment. Markets have wobbled in recent weeks. Investor sentiment has turned cautious. Headlines are filled with talk of tariffs, interest rate shifts, and economic slowdowns.

If you’ve found yourself wondering, “Is this something I should be worried about?”—you’re not alone.

But here’s the simple, grounded truth:

If you’re invested with a clear plan, built on solid foundations, this is exactly the kind of moment that plan was designed to handle.

Let’s talk about how we think about times like this—and why there’s reason for calm.

Market Movements Are Normal, Even Expected

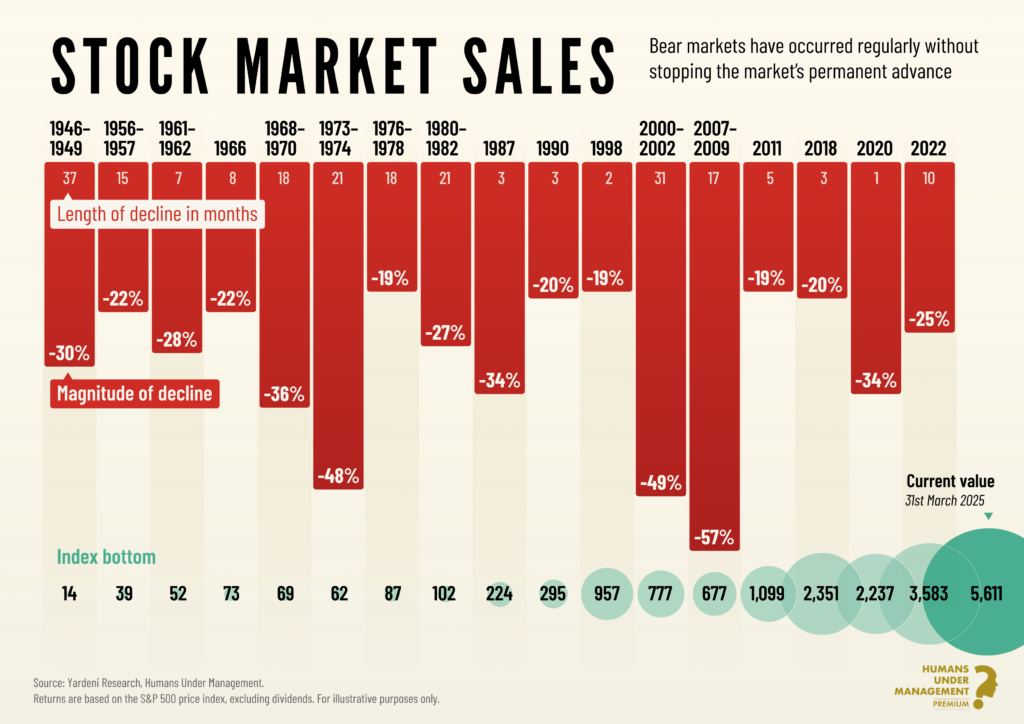

A pullback in markets may feel unsettling, but it’s not unusual. In fact, short-term volatility is a perfectly normal part of long-term investing.

Volatility (variability) is a feature not a bug in markets

Markets don’t move in straight lines—they rise, fall, pause, and rally. It’s the nature of the journey. What matters most isn’t avoiding the bumps, but how we respond to them.

History reminds us that those who stay the course, rather than reacting to short-term noise, are the ones who tend to be rewarded over time.

Looking Through the Microscope

One of the ways we help clients think about their investments is through a microscope analogy.

At the broadest view, we look at your investment strategy: what you’re trying to achieve and what kind of journey you’re comfortable taking to get there. Zoom in, and we see your asset allocation—the balance between shares, bonds, and other asset classes that give your portfolio structure. Zoom further still, and we’re looking at the individual funds we’ve selected.

And then, right down at the most granular level: the companies inside those funds.

Even when markets are volatile, these layers are behaving exactly as they should.

Behind the scenes, your fund managers are adjusting their holdings in response to shifting valuations. When high-quality companies become cheaper—perhaps because they were previously overpriced and now represent good value—those opportunities are quietly being taken.

Your portfolio isn’t passive, even if holds index funds. It’s constantly evolving. It’s working. It’s adapting to the environment using the same disciplined process we built it on.

These moments in markets are only ever temporary declines as the markets march ever on.

Staying Focused on What Matters

At Juniper, our investment philosophy is evidence-based, disciplined and systematic. That means we don’t chase trends or time markets. We rely on decades of research that shows successful investing comes not from predicting what’s next—but from staying committed to a well-built, globally diversified plan.

We focus on what we can control:

- Your goals

- The structure of your portfolio

- Managing risk sensibly

- Keeping costs low

- Rebalancing with discipline

- Avoiding the behavioural traps that cause long-term harm

What we don’t do is let short-term headlines dictate long-term decisions.

A Mindset That Helps in Moments Like This

I’ve been reading more Stoic philosophy lately (I can hear my kids eyes rolling as a type!)—writers like Marcus Aurelius and Epictetus. Their messages are surprisingly helpful in uncertain times.

One line that’s stuck with me:

“You have power over your mind—not outside events. Realize this, and you will find strength.”

We can’t control markets. But we can control our response to them.

That’s where calm, clarity, and long-term thinking win the day.

This Is What Your Plan Was Built For

Whether you’re still building wealth or drawing an income from your portfolio, we’ve planned for market drops. We expect them.

- If you’re accumulating, lower prices mean better long-term value.

- If you’re drawing income, we’ve stress-tested your plan against moments just like this.

- If you’re investing a lump sum read this article

- If you’re unsure how it affects you—talk to us. That’s what we’re here for.

No plan should rest on everything going right. Good plans account for things going wrong—and still help you reach your goals.

Final Thought: Keep Perspective

It’s easy to feel anxious when markets wobble. But this is not the first time we’ve seen it—and it won’t be the last.

Every cycle brings noise, uncertainty, and a few shaky weeks. But over the years, patient investors have been rewarded not for timing the perfect moment—but for staying the course through all of them.

So if you’re feeling concerned, remember:

Your investments are working. Your plan is sound. And you’re not going through this alone.

If you’d like to talk about anything in this note—or just want to check in on how things are going—we’re always happy to chat.

If you’d like to talk to your adviser, please message clientservices@juniperwealth.co.uk and the team will get you booked in.