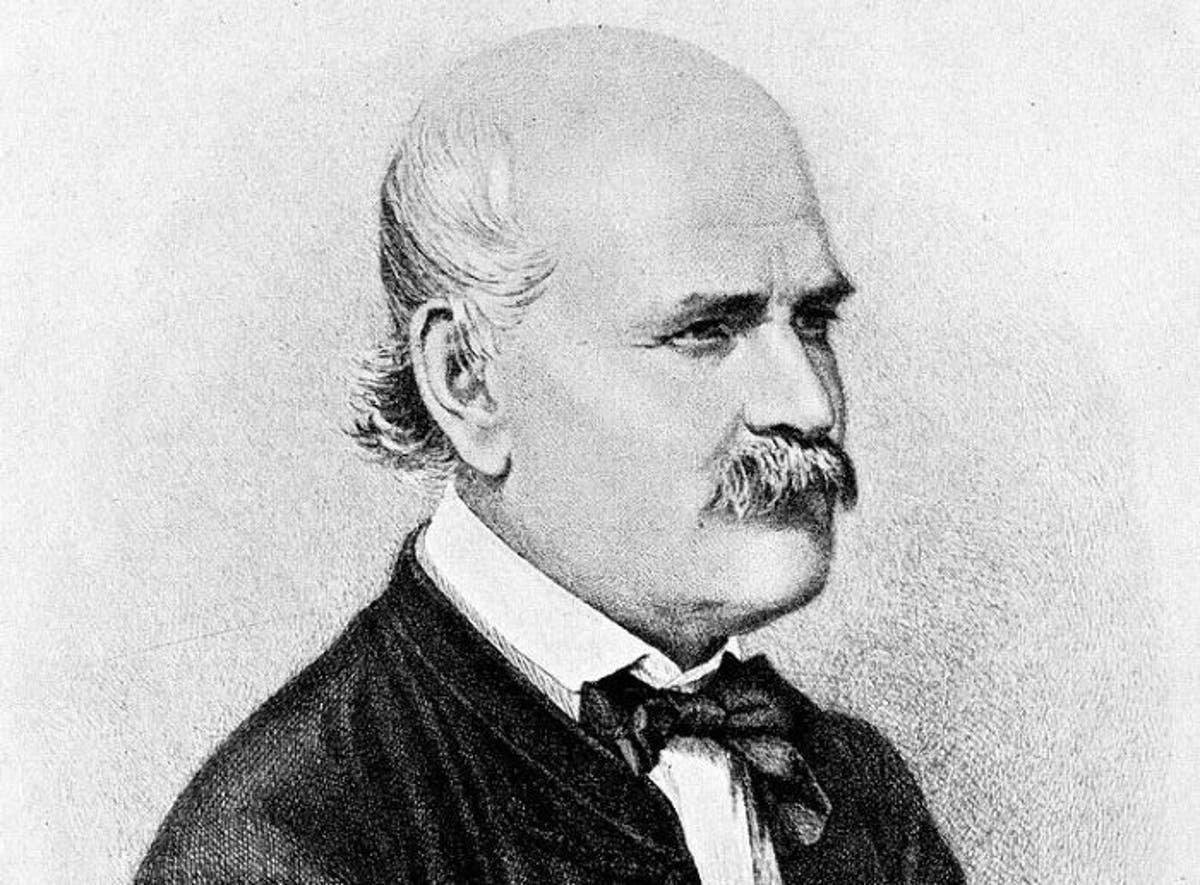

The story of Ignaz Semmelweis is tragic and inspiring in equal measures. Born 1818 in Buda (now Budapest), Hungary,

Semmelweis was a man of his time, according to Justin Lessler, an associate professor at Johns Hopkins School of Public Health.

It was a time Lessler describes as “the start of the golden age of the physician-scientist”. Physicians were expected to have scientific training and were become interested in data analysis as part of their medical research.

Whilst working at Vienna General Hospital’s maternity clinic he started collecting data on mortality rates. Semmelweis noticed that his First Clinic had a much higher mortality rate (10%) than his Second Clinic (less than 4%). Upon studying the evidence he noticed a correlation between the first clinic, staffed by Doctors and Medical Students, and the second clinic, staffed mostly by female midwives.

After testing a few hypotheses he discovered a correlation between Doctors performing autopsies and the high mortality rate. He suggested hand washing as a solution to this problem. The results were astounding. The mortality rate, standing at 18.3% in April 1847, had dropped by July to just 1.2%.

To modern ears, this seems obvious. This was, however, happening before the germ theory of disease was commonly accepted across Europe. Before John Snow’s study on Cholera outbreaks in London, before Pasteur and Koch.

Semmelweis’ contemporaries were outraged. His hypothesis made it look like they were responsible for the death rate and he was dismissed from his position. In 1865 he was committed to a lunatic asylum and died of septic shock just 14 days later.

For investors, I feel there are 3 lessons to take from the life of Ignaz Semmelweis.

Adopt An Evidence Based Approach

The evidence overwhelmingly demonstrates that as few as 1% of active funds beat the market, over the long term, net of costs. Even over the short term they often struggle.

Research from December 2019 shows a staggering 63.76% of UK Equity funds underperformed their benchmark over 5 years whilst 80.60% of US equity funds underperformed their benchmarks over 5 years.

Furthermore, of the few funds who outperform it is near impossible to identify them in advance with any degree of confidence.

The good news is that there is an alternative way, an Evidence-Based Way, of investing. More than 60 years of independent, peer-reviewed, academic research has shown that the most effective way for us to invest is simply to buy and hold a broadly diversified portfolio of low-cost index funds and, other than rebalancing your portfolio systematically to restore the original asset allocation, keep trading to an absolute minimum.

What Seems Obvious Tomorrow Seems Novel Today

We have been taught by the investment industry the secret to markets is to buy low and sell high. They tell us there is frequent ‘mispricing’ of companies that they take advantage of in order to generate performance. But with so many playing the same game they consistently cancel each other out.

Many studies analyse the success of market timing by stock pickers, and none are particularly flattering. But even if they manage to profit from all their trading they still have to overcome a significant hurdle.

They have to outperform after costs and running active funds costs a lot of money.

For Semmelweis to assert that washing hands would save lives seems obvious to us today but at the time it seemed novel, strange and offensive to many,

Similarly when we can adopt an evidence-based approach to investment management seems novel to many today.

Be Wary Of Vested Interests

I read recently that there are now more funds than there are shares to purchase. With so many trying to beat the market it is clear that som will but too many of them fail to do so.

Semmelweis was hounded out of his profession by the very Doctors who stood to lose face if they accepted his hypothesis.

The Active Fund management industry is worth multi-trillion. Over a million fund managers worldwide have entire careers built on their ability to duck, dive and weave their way through markets to outperform an index or a benchmark.

The financial press receives multi-millions in advertising money from fund houses trying to convince you that they have the secret source. Theirs is the secret source to outperformance and greater returns.

As a Finacial Planner, I have a duty to seek the most probable, consistent and likely methods for my clients to achieve their investment objectives and the evidence is in.